Entry Setups: How to Time Your Trades with Precision

We cover 4 powerful and time-tested entry setups for stock trading. These patterns are ideal for positional traders and investors who focus on weekly charts and strong uptrends.

Once you’ve built a watchlist of the strongest stocks in leading sectors, the next step is not to rush in—it’s to wait patiently for the right entry setup. That patience is your edge.

We focus only on the weekly timeframe and look for strong, stable base formations that signal the next leg of an uptrend. Here are the four most powerful setups you need to know:

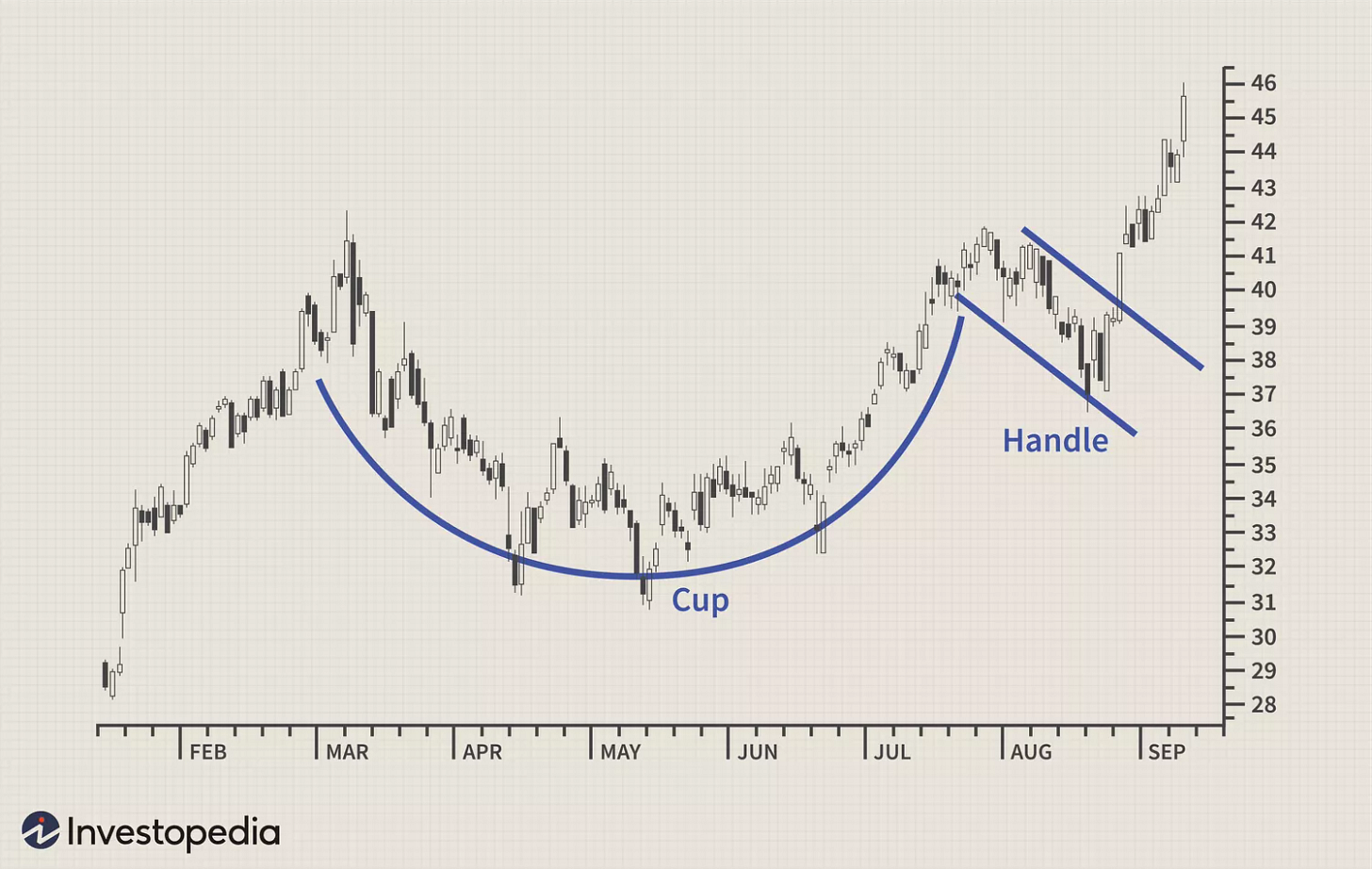

☕ 1. Cup and Handle Pattern

A classic bullish continuation pattern, especially common in growth stocks.

Structure:

Cup: A rounded bottom formed over weeks or months (ideally a 12–33% correction).

Handle: A shallow, downward or sideways drift over 1–4 weeks with lighter volume.

Entry Point:

Buy just above the handle’s resistance, ideally on strong volume.

Example: If the handle high is ₹500, enter around ₹502–₹505 with volume confirmation.

Why it works:

It shows a healthy consolidation after an uptrend—buyers are regrouping before the next move.

📊 2. Flat Base Breakout

A flat base is a powerful sign of quiet accumulation by institutions.

What to Look For:

Tight, sideways movement over at least 5 weeks

Price range should stay within 15% top to bottom

Low volatility and clean structure

Entry Point:

Buy just above the pivot point (the highest level in the base) on above-average volume.

Use a stop-loss about 3–5% below the base low.

Why it works:

It reflects strength under the surface and often precedes explosive moves in bull markets.

🔺 3. VCP (Volatility Contraction Pattern)

Popularized by Mark Minervini, the VCP is all about tightening price action and shrinking volatility—a sign that sellers are exhausted and demand is building.

Key Traits:

A series of contractions, each shallower than the last (e.g., -20%, -12%, -6%)

Higher lows and tightening range

Volume Dry-Up (VDU) before breakout

Entry Point:

Buy just above the last contraction high, ideally on strong volume.

Place a tight stop-loss just below the breakout area.

Why it works:

It reflects institutional accumulation and provides a low-risk, high-reward entry just before a major breakout.

📉 4. Pullback to 20-Day Moving Average (20DMA)

A simple but effective setup—buying into strength after a shallow pullback.

What to Look For:

A strong stock in a Stage 2 uptrend

A pullback on light volume toward the 20DMA

A bullish reversal (like a hammer or bullish engulfing candle) near the moving average

Entry Point:

Buy as the stock reclaims the 20DMA on above-average volume

Why it works:

It offers a low-risk entry within an existing trend, especially when broader markets are supportive.

✅ Final Tip: Wait for Confirmation

Whichever setup you use, always:

Confirm Wide Range Candle breakouts with exceptional volume

Check RS line highs for relative strength

Align with overall market direction for added conviction